FP&A software that unifies finance and the enterprise for faster decisions.

Board’s FP&A software connects corporate and business unit finance teams with continuous planning, dynamic forecasting, and scenario modeling – enabling FP&A to deliver speed, accuracy, and confidence through volatility.

Powered by purpose-built AI agents that automate modeling, enhance analysis, and improve forecasting.

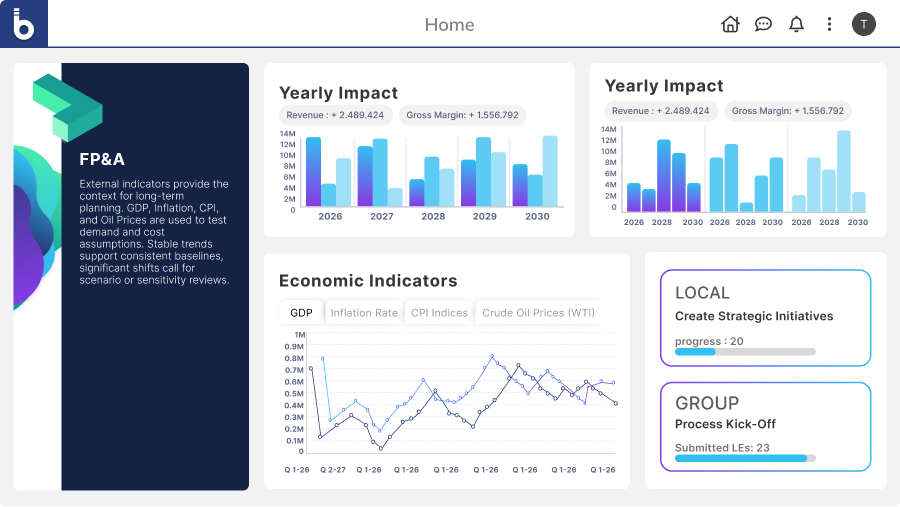

Board enables Financial Planning and Analysis (FP&A) to move beyond static annual cycles to continuous planning and scenario modeling – aligning strategy, operations, and financial outcomes in real time.

Support confident decision-making with rolling forecasts and scenario modeling so leaders can adapt as conditions change.

Accelerate planning cycles

Shorten planning and reforecasting cycles by eliminating manual data collection and reconciliation – keeping teams aligned and responsive.

Focus on delivering insights

Reduce time spent preparing data and increase time spent explaining drivers, evaluating scenarios, and advising the business.

Enable business partnering

Give FP&A real-time visibility into financial and operational performance so finance becomes a trusted partner in decision-making, not a reporting function.

FP&A Agent: AI designed for how finance actually works.

Augment FP&A with accounting-aware, domain-specific AI that accelerates modeling, scenario analysis, and cash flow forecasting – without replacing financial judgment.

Real partnership between finance and AI begins today.

The Board FP&A Agent transforms finance into a strategic powerhouse by automating planning, modeling, and financial statement analysis so your teams spend less time verifying numbers and more time shaping decisions that drive growth.

Our AI agents won’t simply assist finance teams. They will partner with them. Welcome to the agentic era of finance.

Built for FP&A use cases that matter.

3-Statement

Modeling

Instantly validate relationships across P&L, balance sheet, and cash flow to improve forecast accuracy and scenario confidence.

Integrated Financial Statement Analysis

Continuously surface trends, anomalies, and key drivers across all three statements- so FP&A can explain results, not just report them.

Cash Flow & Liquidity Management

Anticipate liquidity risks by analyzing drivers of cash movement, identifying anomalies, and modeling corrective actions in real time.

Explore our FP&A solutions:

Built to support the full FP&A lifecycle from strategic planning to cash flow forecasting.

Management Reporting and Analysis

Cash Flow Analysis and Forecasting

Trusted by enterprise finance teams worldwide.

What FP&A leaders say about Board

Recognized by analysts. Trusted by finance leaders.

Board is globally recognized by analysts, peers, and subject matter experts.

Board is a Leader in the 2025 Gartner® Magic Quadrant™ for Financial Planning Software.

Get the reportBoard scored among the four highest-ranked (tied) vendors in the 2025 Gartner® Critical Capabilities for Financial Planning Software.

Get the report

Resources to stay ahead.

The 2025 Gartner® Magic Quadrant™ for Financial Planning Software

A Guide to Enterprise Performance Management in the Era of AI

FAQs

Board’s F&A software by itself doesn’t assist with compliance and financial reporting standards. Our Enterprise Planning Platform assists with this through the Board GCR solution. Board CGR meets global reporting requirements while using data for analysis. We comply with US GAAP, IFRS, and local statutory reporting requirements as well as enabling users with self-service reporting and visualizations.

Board’s FP&A software seamlessly integrates with existing financial systems through open APIs and pre-built connectors. It consolidates data from ERP, CRM, and other financial tools, ensuring real-time synchronization, accurate reporting, and smooth workflows across your organization.

Yes, Board’s FP&A software is fully customizable, allowing businesses to tailor dashboards, reports, and workflows to their specific industry needs. Its flexibility ensures seamless integration with existing systems, adapting to unique financial processes and regulatory requirements.

Board offers comprehensive support, including training webinars, on-demand tutorials, user guides, and a dedicated customer success team. Our interactive learning resources, the Board Academy, and our Partner Hub ensure users can quickly adopt and maximize the platform’s capabilities.

Board’s FP&A software centralizes financial and operational data, external data, and reporting, enabling cross-departmental collaboration. Teams can share insights, align forecasts, and make data-driven decisions in real time, improving transparency and efficiency across the organization.

Board employs enterprise-grade security, including encryption, access controls, and compliance with global data protection standards. Role-based permissions and audit trails ensure financial data remains secure and only accessible to authorized users.

Yes, Board’s FP&A software scales with your business, handling increasing data volumes and complexity. Its flexible architecture supports growing financial needs, ensuring seamless performance from startups to large enterprises.

Board supports multi-currency transactions and global financial consolidation, ensuring accurate reporting across different regions. Automated currency conversion and localized compliance features help businesses manage international operations efficiently.

Board offers cloud, on-premises, and hybrid deployment options to fit diverse business needs. Its flexible architecture ensures seamless integration, security, and scalability, whether hosted in the cloud or within an internal IT environment.

FP&A software helps businesses plan, analyze, and forecast financial performance. It integrates data, automates processes, and provides real-time insights to support strategic decision-making. By improving data accuracy and process efficiency, it enables finance teams to share real-time insights and take control of their company’s performance.